Chestnut Park Real Estate Market Report – Muskoka Region Q1 – 2024

Prepared by: Chris Kapches, LLB, President and CEO, Broker

Chestnut Park Real Estate, Ltd, Brokerage

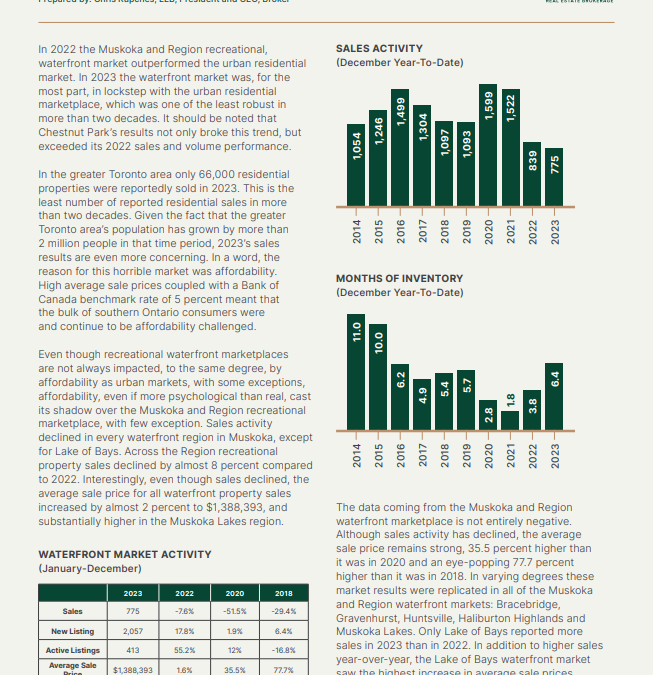

The data flowing from the first three months of recreational waterfront activity in the Muskoka region is reminiscent of the way the recreational resale market operated prior to the pandemic, that is prior to the first quarter of 2020. At least for the most part. Some aspects of the market appear to have changed forever. Specifically, average sales prices. What also emerges is the return to seasonality. Historically the first quarter in southern Ontario’s recreational markets has been seasonally slow, and that is what we are seeing in the first quarter of 2024.

A review of the overall regional market indicates that compared to the same quarter last year the results are positive. Sales have increased by almost 8 percent compared to last year, although dramatically lower than the number of sales that were achieved during the pandemic years of 2022 and 2021 when the desire to acquire a recreational property, far from the density of cities, was feverish. Sale of waterfront properties have effectively returned to pre-pandemic volumes.

The same is true for supply, months of inventory and the number of days waterfront properties spent on the market during the first quarter. Supply increased by almost 60 percent compared to last year, bringing the total months of inventory at the end of the first quarter to almost 11 months, 7.3 percent higher than inventory levels last year. It is not surprising therefore that during the first quarter waterfront properties (on average) took 29 days to sell. In all these categories, first quarter numbers are very similar to first quarter numbers in 2019.

The major market divergence is in average sale prices. The average sale price for all waterfront properties sold in the first quarter of 2024 came in at $1,123,224. Although not as high as prices achieved during the height of the pandemic, which had climbed to $1,300,000, first quarter average sale prices were 1.5 percent higher than last year and an eye-popping 61.4 percent higher than waterfront sale prices achieved in the first quarter of 2019. In other words, average sale prices for waterfront property in 2019 were approximately $700,000.

Waterfront Market Activity

Sales activity in the various waterfront markets within the Muskoka region produced varying results primarily because the number of reported sales was limited. For example, waterfront sales activity around Bracebridge and Gravenhurst was limited to 7 and 8 properties, respectively, again a reflection of the return to seasonality. These small numbers make any attempt at market analysis and forecasting difficult and somewhat meaningless after the first quarter. For example, waterfront sales in the Bracebridge area were down by 12.5 percent compared to last year, yet up 166 percent in waterfront properties in the Gravenhurst area.

Similarly, there was very little activity in the Lake of Bays waterfront market. During the first quarter only 6 properties were reported sold, 62 percent less than reported sales in 2023. Having said that, first quarter waterfront sales in Lake of Bays were 50 percent higher than sales achieved in 2019, again signs of the return to seasonality. However, like all waterfront marketplaces in the Muskoka region, average sale prices increased dramatically. Lake of Bays first quarter average prices came in at $1,414,209, 54.4 percent higher than last year and 33.3 percent higher than in the first quarter of 2019.

Lake of Bays Waterfront Market Activity

The sales activity coming out of the Muskoka Lakes was very similar to that of Lake of Bays. Only 7 waterfront properties were reported sold in the first quarter, substantially lower than sales activity last year. Those 7 sales produced an average sale price of $2,134,587, 10.5 percent higher than first quarter average sale prices in 2023, and a shocking 100 percent plus more than average sale prices in 2019. It should be noted that these waterfront properties all sold in only 19 days. During the first quarter of 2019 all waterfront properties on the Muskoka Lakes sold in 61 days, even though they were 100 percent less expensive than they are today.

What distinguishes the Muskoka Lakes is the number of sales from a historical perspective. First quarter sales were low, even by a pre-pandemic analysis. This is no doubt due to two factors. Firstly, average sale prices are so elevated that the pool of potential buyers has been reduced, and secondly, many Muskoka waterfront properties are sold exclusively, data that is not available through the Multiple Listing Service. For example, even though only 7 waterfront properties were reported sold during the first quarter, Chestnut Park’s sales representatives alone were responsible for 17 waterfront sales during the first quarter throughout the Muskoka region, many of these being off market sales.

Muskoka Lakes Waterfront Market Activity

Contrary to market trends, Chestnut Park’s sales representatives had a very fast and positive start to 2024. While the overall market was up by 7.6 percent in the first quarter, Chestnut Park’s sale volumes increased by more than 12 percent compared to the same period last year. More impressively, Chestnut Park’s sales representatives were engaged in transactions having a dollar volume of more than $53 million.

As we move into the second quarter the waterfront market is accelerating seasonally, as it did in the past, before the pandemic created unprecedented numbers of sales and average sale prices at the beginning of the year, when conditions made accessing properties extremely difficult. Based on Chestnut Park’s first quarter results, early second quarter results appear extremely positive.

As of the end of the first quarter, Chestnut Park has been responsible for 37 sales transactions. Average sale prices, as first quarter data indicates, will remain strong. If the Bank of Canada reduces its benchmark rate, as is anticipated (by June or July), cheaper money will no doubt result in even higher average sale prices, prices approaching the record levels achieved during the frenzied height of the pandemic.