Dave Smith is an established Real Estate Broker with Chestnut Park Real Estate Ltd, Brokerage – Lake of Bays Realtors and Project Management Consultant, who has dedicated his entire professional career of over 30 years to the resort, recreation, golf course and water resource industries. He was involved with the successful development of the popular Muskoka golf course and waterfront community on Bigwin Island in Lake of Bays and has most recently become a partner in the Launch of FRESH20, a sustainable solution to reducing single use plastic waste.

Being a full time resident and business owner in Muskoka provides Dave with a vast amount of knowledge and experience specific to this region and allows him to leverage these assets on behalf of his clients and business initiatives. He also believes in the importance of being involved and giving back to the community. He is proud to have recently served 9 years on the Board of South Muskoka Hospital Foundation as an Executive Director and the Treasurer. He is also current a Director of the Bigwin Island Community Foundation.

Dave was asked recently what his thoughts are on the current Real Estate Market in Muskoka, given the current economic and political landscape. Read on for Dave’s Two Cents!

2025 Year-End Waterfront Market Update | Lake of Bays & Muskoka

As we enter the holiday season and get ready to say so long to 2025, it is fair to say that, from a real estate perspective, this was a year to survive rather than thrive. Instability driven by factors such as U.S. tariffs, along with ongoing concerns about the broader economy, clearly influenced buyer and seller behavior in the real estate market. On a more positive note, the market is showing signs of returning to a more stable, predictable pattern, rather than the extreme highs and lows of the COVID period.

For decades prior to COVID, real estate was viewed as a steady, relatively safe investment, with historical annual returns in the 4% to 5% range. The current trend suggests a gradual move back toward that more traditional, sustainable profile, which is ultimately healthy for both buyers and sellers.

Lake of Bays Waterfront: 2025 at a Glance

The 2025 Lake of Bays waterfront market has been slower and more negotiable than in the past few years. There have been fewer sales, longer selling times, slightly lower average prices, and buyers are paying a smaller percentage of the original asking price than before. While these statistics are specific to waterfront properties on Lake of Bays, the overall patterns are very similar across the broader Muskoka market.

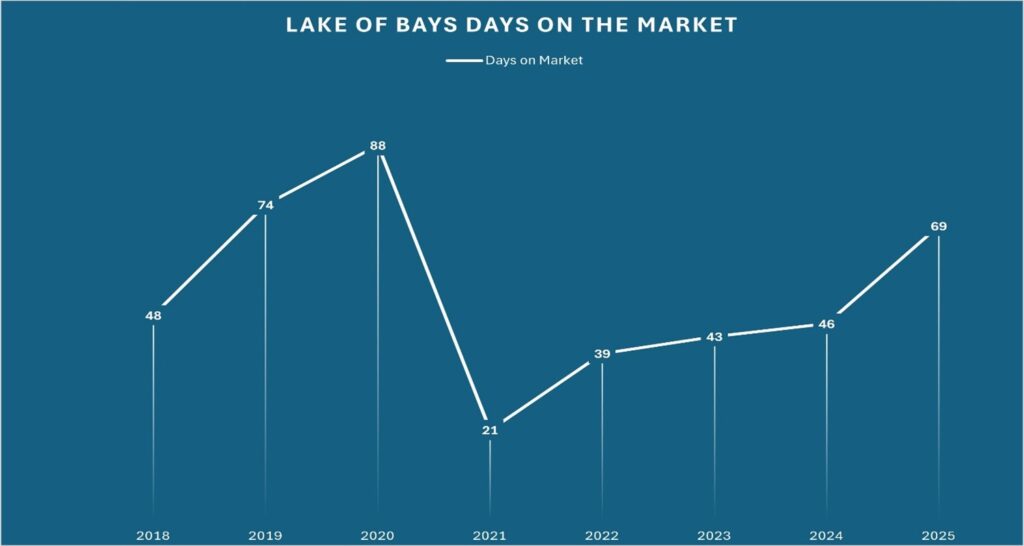

Days on Market – Days on market have increased to 69 in 2025, up from 46 in 2024 and well above the very rapid 21 days seen in 2021. This shift indicates that listings are taking longer to sell, and buyers now have more time to conduct due diligence and make decisions, rather than feeling forced into rushed, competitive bids.

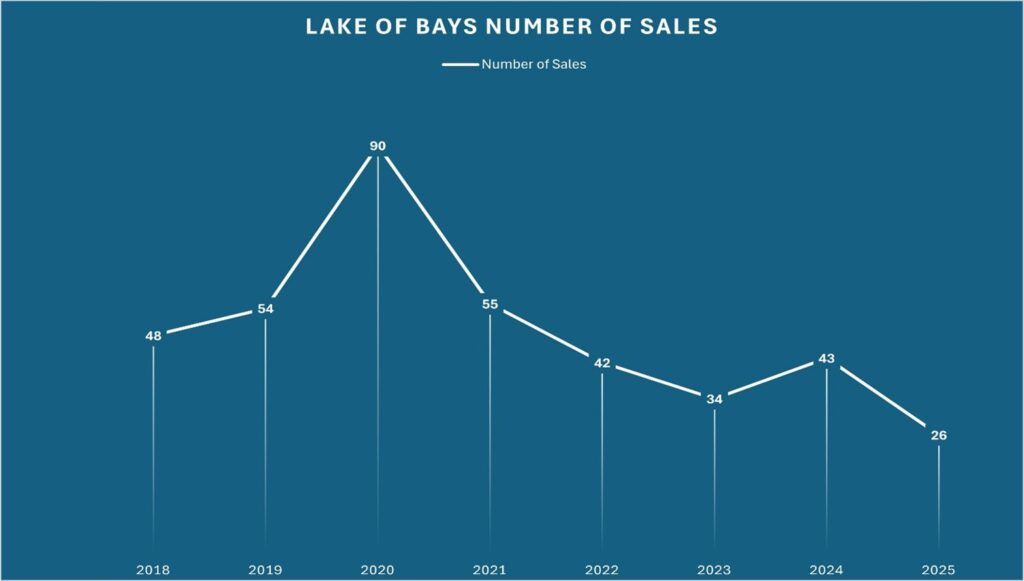

Number of Sales – Sales volume has cooled significantly. The number of sales has dropped to 26 in 2025, down from 43 in 2024 and well below the COVID‑era peak of 90 in 2020. This reflects materially lower transaction activity and a market that has moved away from the frenzy of the pandemic years.

Average Sale Price – The average sale price in 2025 is approximately $1.95M, down from roughly $2.24M in 2024 and from the $2.76M high in 2023. This points to a clear step down from peak pricing, though values remain well above pre‑COVID levels. For long‑term owners, this still represents substantial appreciation over the past decade, even if prices have moderated from the top.

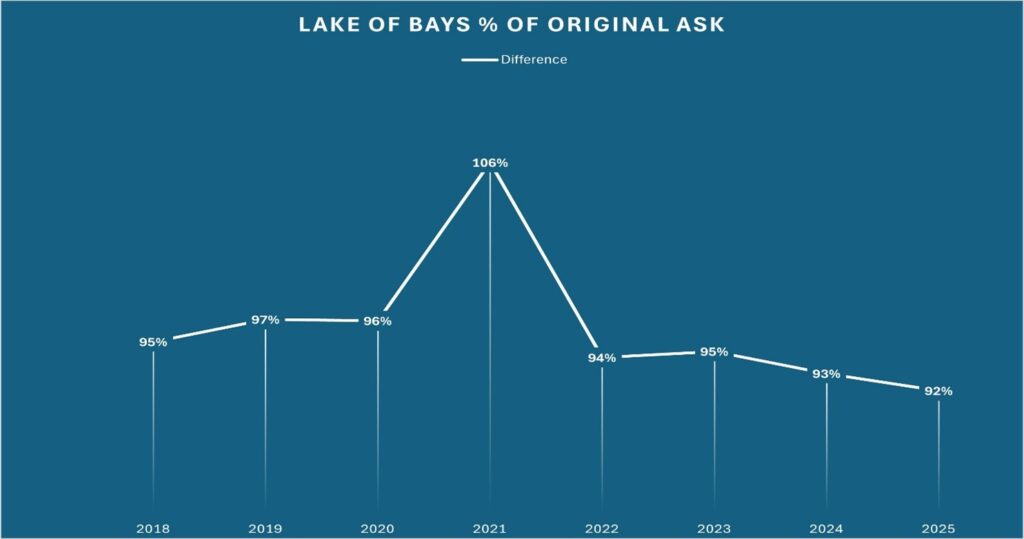

Percentage of Original Asking Price – Buyers are now paying about 92% of the original asking price in 2025, compared with 93%–96% in most years and an exceptional 106% at the 2021 peak. This shift signals more room for negotiation, fewer multiple‑offer situations, and less pressure on buyers to bid over asking to secure a property.

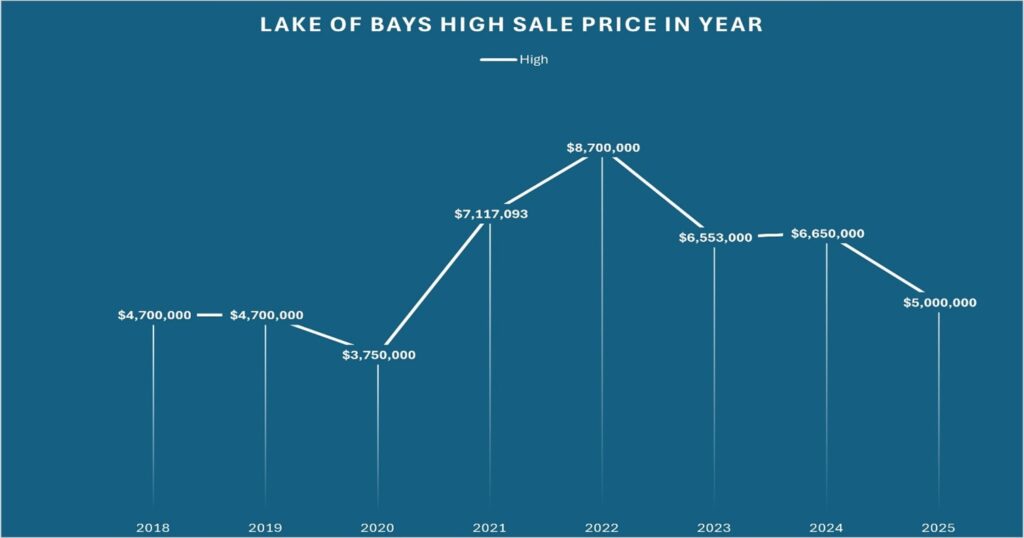

High-End Waterfront Segment – At the top of the market, the highest sale in 2025 is about $5.0M. This is below the $8.7M peak recorded in 2022 and the mid‑$6M range seen in 2023–2024, indicating that the ultra‑high‑end segment has also cooled from its highs. However, that $5.0M figure is still above the 2018–2020 range, reinforcing that while the market has come off the boil, it has not reverted to pre‑COVID pricing.

Overall Market Tone – Overall, the market is slower and far less frenzied. Sales counts are down to 26 from a peak of 90 in 2020, and properties now sit on the market for about 69 days versus just 21 days at the 2021 peak. Conditions feel more balanced—perhaps even slightly buyer‑leaning—rather than the pure seller’s market experienced during the pandemic.

Pricing and Negotiation Environment – From a pricing standpoint, the average sale price has stepped down from the 2023 high of about $2.76M to roughly $1.95M in 2025 yet remains significantly above 2018–2019 levels. Buyers now typically pay about 92% of the original asking price, compared with the mid‑90% range in most years and 106% in 2021. For buyers, this means more negotiating power and less urgency to bid aggressively. For sellers, it underlines the importance of realistic pricing and strong presentation from day one.

Looking Ahead in 2026

Whether you’re considering buying, selling, or simply keeping an eye on the market, understanding these trends can help you make informed decisions moving into 2026. If you’d like to talk through how the current market applies to your specific property—or explore what opportunities might exist as a buyer—the team at Lake of Bays Realtors would be happy to help. Every property and situation is unique, and a conversation with a knowledgeable local REALTOR® is often the best place to start.